If there’s one thing people hate about getting insurance in New Zealand, it’s the premiums that tend to go up in price over time. However, did you know that there’s a way to make sure you end up paying the same premium over time?

Just like fixing your mortgage interest rate to have the same repayments for a set amount of time, you can also lock in your insurance premium at a fixed rate. This strategy, called level premium insurance, allows you to lock your insurance premium at a fixed rate so your payments stay the same for the next 5, 10 or even 20 years.

Why should you fix your premium early?

It’s common knowledge that the older you get, the more expensive the premiums you get charged by insurance companies. That’s why locking in your premium as early as possible is a great way to save money over time – especially if you are planning to keep your cover on a long-term basis.

Locking in your premium early is a great way to:

- Protect your family’s financial future

- Free up more money to pay off other debts (such as your mortgage) or grow your savings and investments

- Make it easier to keep up with your premiums over time, allowing you and your loved ones to stay covered and get peace of mind

Example: Daniel is preparing for his future

Daniel, age 25, sat down with an adviser to discuss his insurance needs. He just bought his first home, and wanted to make sure he could cover his mortgage payments. He also wants to pool together money for a legacy fund in the future.

After the discussion, Daniel’s adviser recommended splitting his life cover into two separate policies – one ‘short-term’ policy and another ‘long-term’ policy.

Short Term Cover (also known as ‘Stepped Premium Policy’)

This short-term cover is designed to cover Daniel’s current financial obligations, such as his mortgage or ensure he and his loved ones are financially protected in case he becomes unable to work or passes away.

With this in mind, Daniel chose a ‘stepped premium’ plan, which starts lower but increases in price as he grows older. This will help Daniel free up more money in the immediate term to address his short-term needs.

As Daniel pays off more of his mortgage in the future, he can then review his policy with his adviser once more to match the now lower mortgage debt he has (which will also reduce his premiums).

Long-Term Cover (also known as a ‘Level Premium Policy’)

For Daniel’s long-term goals, such as providing a legacy fund for his family, he locked in a ‘level premium’ plan up to age 65.

This allowed him to fix his premiums for this plan at a fixed rate of $105 per month for 40 years.

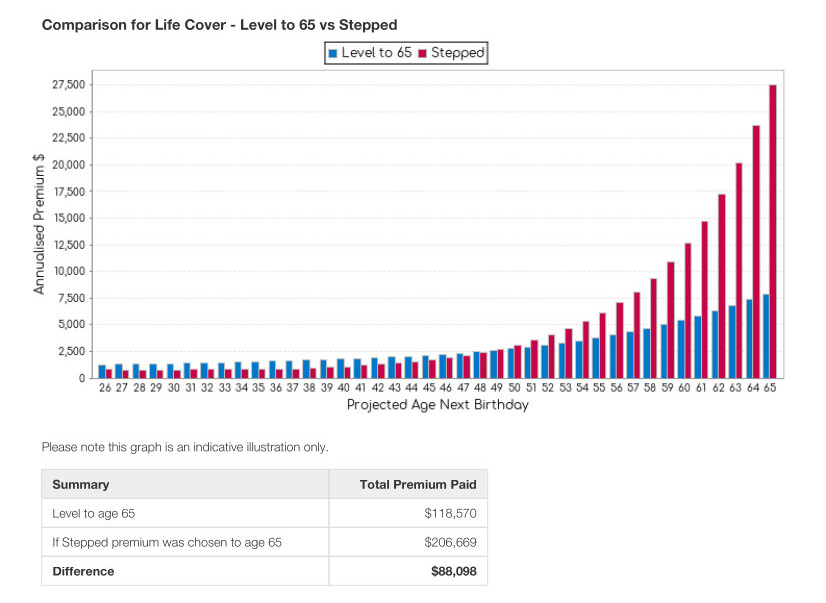

Compared to his short-term ‘stepped premium’ plan, this roughly costs about $38.50 more each month. However, by around age 48, the costs between the two plans will begin to intersect, with the long-term level premium insurance becoming cheaper from this point onwards.

If Daniel sticks to this plan until age 65, he would end up saving around $88,000 compared to staying on a stepped premium the entire time.

To summarise, think of structuring your insurance payments like investing early in your KiwiSaver. The earlier you fix your premiums and stick to a solid payment structure, the more you end up saving in the long run.

Final Thoughts: Buying Insurance in New Zealand the Smart Way

Getting insurance isn’t just about taking out a policy to make sure you and your loved ones are financially protected. It’s also about buying these policies with a smart payment strategy in mind.

Buying insurance isn’t just about getting a policy and paying premiums. It’s about making smart choices that fit your life now and in the future.

By combining stepped premiums for short-term cover with level premiums for long-term protection, you can create a cost-effective and flexible payment plan to help you stay financially ahead for both your short-term obligations and long-term plans.

Let’s Chat!

If you are interested in exploring how much you can save by employing this insurance payment strategy, or want to go over your current insurance plan, fill out the form below.

Our licensed insurance adviser will give you insurance recommendations and advice in plain language through our free insurance review session.